DavLar Weekly Digest - Edition #8

When Markets Panic, Stay Boring: Moroccan Markets Face Turbulence as Global Risks Collide With Local Optimism

Volatility, War Headlines, and an IPO: Morocco’s Market Gets Stress-Tested

Welcome back to the DavLar Market Digest, my newsletter on financial sector themes. I hope you are well and preparing your summer vacation; Mine has started driving California's central coast, walking hills and tasting local delicacies. It gave me time to ponder some reflections and I’ve decided to share them with you. Read on and I’ll explain...

Before that, let me start with a quote that I like bezzaf! Because it is really life changing when you use it in your daily life. “The older I get the more I realize how many kinds of smart there are. There are a lot of kinds of smart. There are a lot of kinds of stupid, too.”- Jeff Bezos

About 4 months ago, I sent out the first edition of DavLar Digest. I thought it would be fun to share what I was seeing, first via LinkedIn (I had an informal newsletter going on through timely posts), though I had no idea how many people would follow along. What motivated me was a curious disconnect and a strong desire to bring a new lens to the Moroccan financial landscape readers.

DavLar Market Digest is independent and we write with our own voice, our own style, our own flair… we run with our own intuition! This is our pledge to you. I understand that we cover certain topics that might be controversial - the nature of the subjects makes it so - but remember dear reader that we are here to elevate the debate and not to side with one or the other. What I share here isn’t full-blown equity research. I’m not handing out stock tips or crunching earnings models. I’m simply sharing what I’ve learned from 15+ years in investing. Over time, I’ve noticed there’s often a missing piece in financial content: the why behind industries — the history, the context, and the big-picture trends that actually shape markets over time.. DavLar Market Digest is my contribution to filling that gap in the financial services sector.

The newsletter has grown beyond my expectations and along the way DavLar Market Digest has found its voice in an abundant market for content. The Substack newsletter format allows me to provide more analytical depth than the conventional news media adding context, narratives and investment theses often missing in the classical platforms.

Of my favorite readers comments captures well what I strive for:

“Thank you for your work ! I absolutely love the way you manage to transform somewhat complex financial ideas into simple terms with explanations and examples.”

“Your style stands out. It’s packed with substance and rich insights, yet still easy to follow — experts pick up new perspectives, and beginners can grasp the key ideas. Honestly, I haven’t seen anyone else in financial journalism who delivers it quite like you do”

I am not “breaking sugar” on the back of other financial authors (famous French saying that translates into trash talking someone), its just that an incredibly talented person can quickly become mediocre when you force them to be someone they aren’t. For example, meet Simo and Rania, they have just joined a big news media company, after a long career of running a big blog following where they quickly fizzled into irrelevance. On their first day they were told “This is not how we do things here. Here is our style book, you must follow it “mot par mot”. And meet Ghita, she is your new editor. She will tell you what to write and when to write it! Good day guys!

When our successful bloggers were doing it their way, they were successful. Their only downfall? Being trapped in a corporate world with hidden agendas, subjective views and conflicts of interests

Even if you’re not an entrepreneur, there’s so much to learn from that.

We all love to say “everyone’s different” — different lives, dreams, skills, mindsets. But the minute someone asks “what’s the best way to invest / spend / save?”, suddenly they expect one magic answer that works for all 8 billion humans. As if there’s a single universal recipe. Like couscous — same ingredients, but trust me, my grandma in Tetouan makes it nothing like yours in Marrakech.

Money is where this illusion becomes dangerous. Most people don’t blow up their finances because of bad plans. They blow up because they copy a plan that wasn’t built for them.

Maybe your aggressive speculative portfolio makes you sleep like a baby. That same portfolio would keep me up all night sweating like a chicken in a Marrakesh souk. And that’s perfectly fine. The real risk? You convincing me to copy your strategy, or me convincing you to follow mine — even though our nerves, skills, and goals are completely different.

Same story with spending. You want to blow $500 on a pair of sneakers? Great. I want to blow $500 on books and espresso machines? Equally great! Koulla wahed yder li gallih rasso! (Translates to do whatever suits you!). But we start getting stupid when we assume that different spending choices mean one of us is right and the other is wrong. As if your spending habits are an indirect judgment of mine.

That’s where jealousy, insecurity, and social media nonsense fuel financial anxiety.

The truth? The best strategy is the one you can stick to. The one that fits your personality, your skills, your limits. You can learn from others — sure. Stay curious, stay humble. But don’t copy-paste. Adapt.

Because once you play your game:

You stop losing sleep about what others think

You compete against your own benchmarks, not your neighbor’s Instagram

You give yourself an actual shot at getting what you want in life - which, newsflash, is the whole point.

Now lets get back to what happened recently in the market, I have been following the reaction of the Casablanca Stock Market to the Israel-Iran war and I want to tell you something:

“Your investment timeline should dictate your emotional response”

One of the most powerful and dangerous behavioral traps in investing is recency bias: the tendency to overweight recent events and assume that what just happened will continue indefinitely

- When markets rise for months, we believe corrections are impossible

- When markets drop 5% in a week, we convince ourselves that this is just the beginning of a major crash

Both are usually wrong. In moments like this, ask yourself:

If you were excited to buy Moroccan stocks two weeks ago at MASI 18,600, why would you now panic at MASI 17,600? Has the intrinsic value of Moroccan businesses collapsed in one week?

The answer, of course, is no.

What has changed is your emotional state, not the underlying fundamentals.

Successful investing is less about predicting markets, and more about managing your own psychology

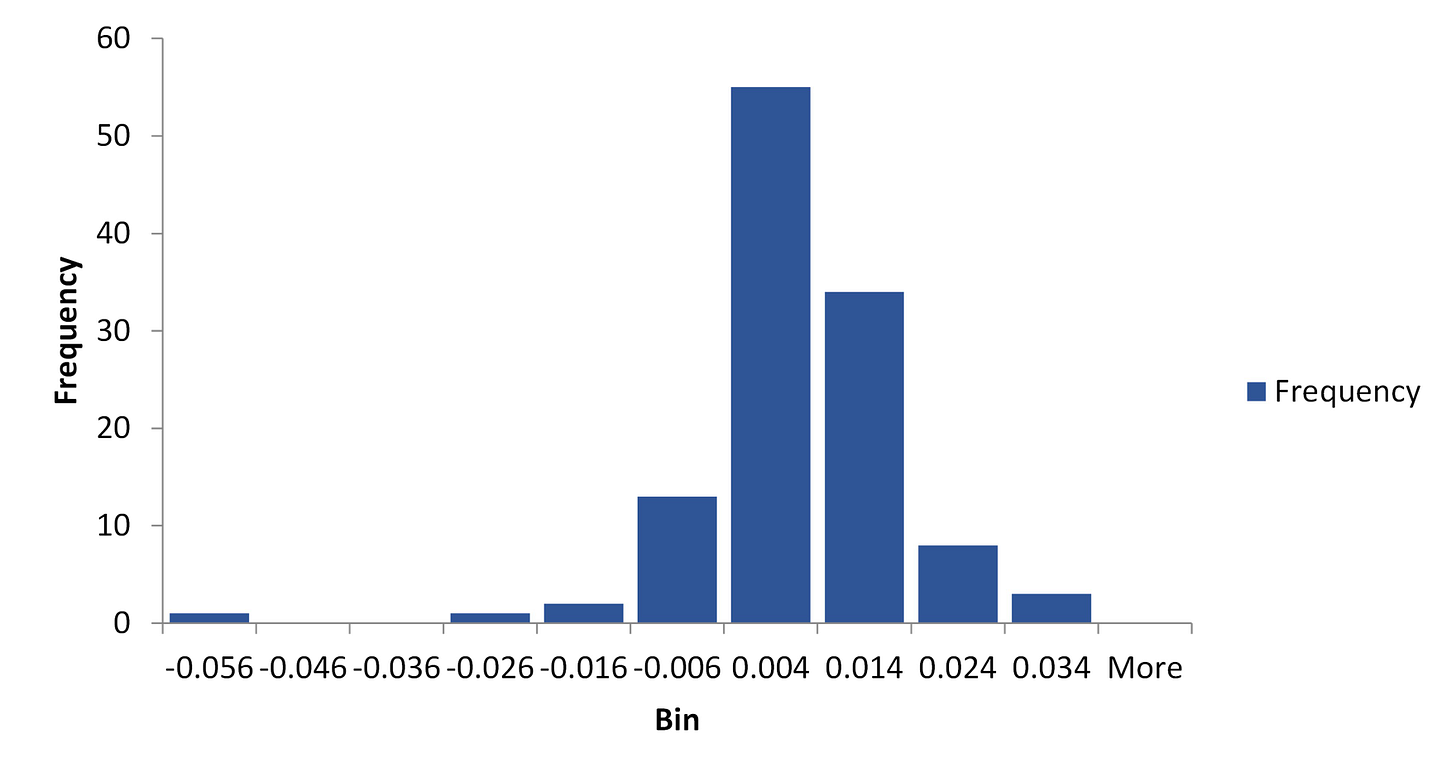

Distribution of MASI daily returns since Jan-2025

Source: Personal analysis

So far this year, when I analyzed the daily returns of the MASI (117 observations) since January 2nd, the probability of hitting a positive return is ~61% vs the probability of hitting a negative return is ~39% (I observed a similar pattern in 2024 during the same dates). So chill :)

Then, I pushed the analysis further to have an idea about volatility. We hear this word a lot, what is it exactly?

Volatility is simply:

How much your investment dances around when chaabi music is playing!When a stock moves +5% one day, -3% the next, +4% the day after — that’s high volatility. When it moves +0.1%, -0.2%, +0.15% — that’s low volatility.

Think of it like driving on the road from Chefchaouen to Tetouan:

Smooth turns: low volatility.

Crazy mountain curves, blind corners, wild goats crossing: high volatility.

Volatility measures how much prices fluctuate — not whether they go up or down

Why do we care?

Because volatility messes with your emotions.

It’s not risk of losing money.

It’s risk of you doing something stupid because prices are jumping too much.The more volatile an asset is, the harder it is to hold long term even if fundamentals are strong.

How do we calculate it?

Technically, it’s simple: (1) you collect daily (or weekly, monthly) returns of the stock. (2) You calculate the standard deviation of these returns — that’s your volatility.

Formula: Volatility=Standard Deviation of Returns. If the daily returns of your stock swing wildly, the standard deviation will be high → high volatility.

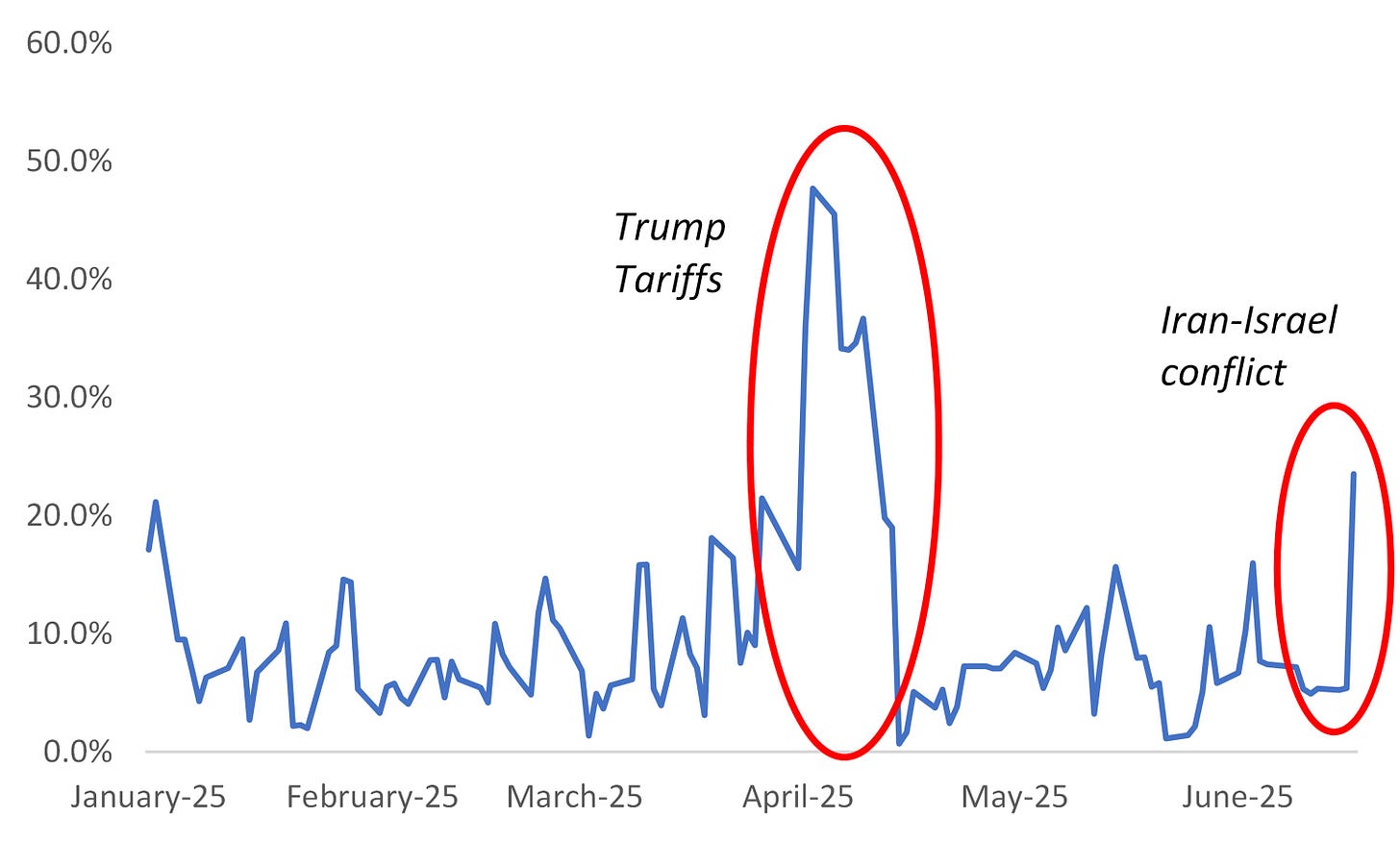

Rolling 3-day volatility of MASI

Source: Personal analysis

We can clearly see that during April and now June, the MASI index experienced elevated volatility due to a mix of global shocks and local market reactions.

Recently, the Casablanca Stock Exchange has experienced sustained selling pressure across multiple sessions, with the MASI showing synchronized weakness. This suggests broad-based sentiment deterioration rather than sector-specific issues

Global Trade-Tariff Turbulence

U.S. Tariff Surprise: President Trump announced sweeping tariffs on a wide range of imports, triggering a sharp global sell-off in April

This shockwaves rippled through emerging markets, including Morocco, rattling investor sentiment and driving volatility across the board

Geopolitical Anxiety

More recently, Iran and Israeli are exchanging missiles + the unclear position of whether the US will be joining the war created waves of tension in global markets

Technical Breakouts & Profit-Taking

The MASI surged over 20% in Q1 2025

From late March to April, MASI broke key technical resistance around 17,450, then saw profit-taking and pullbacks as traders assessed whether the breakout was sustainable

How It Played Out

Local investors faced a perfect storm: global macro shocks + sudden geopolitical risk + local technical shifts = heightened volatility (to the sky)

Classic cross-sectional reaction: fear-driven selling followed by strategic buying — mutual funds stepped in once sellers cleared out .

Big reactions, but none changed the ingredients—the underlying economy, corporate profits, demographics.

Morocco’s Fundamentals Remain Intact

It’s crucial to remember that market prices and economic fundamentals operate on different timescales. The MASI’s decline doesn’t reflect any deterioration in Morocco’s underlying economic strengths

Lesson Learned (Yes or No, be honest even if you panic-sold your favorite stocks)

For our Couscous Investors: The 3 Golden Rules

Those revolve around know your time horizon and why you're in MASI

If you're long-term, these are just souk noise—not a fundamental collapse. For short-term traders, volatility can mean opportunity... or stress

Diversify to survive (or at least try)

1. Signal or Noise?

Markets go up, markets go down — like sardine prices in M’diq before Eid. But does Morocco suddenly become an economic disaster every time Wall Street sneezes? Of course not. We’re still:

perfectly placed between Europe, Africa, and the Gulf,

with a Dirham that holds its ground like a proper sfifa,

and banks that sleep better than you do.

So before you panic because the MASI drops -2%, ask yourself:

Have the businesses you own truly lost their long-term value? Or is this just a crowded souk full of noisy sellers chasing rumors on social networks or coffee breaks?

2. Time Horizon is King

Are you investing for your retirement 20 years from now? Or to pay for the summer trip to Cabo Negro next month? Because that changes everything.

If you’re here for the long game, a market drop today is like couscous that sticks a bit during the first steam — it works itself out. But if you need that cash next year to buy a plot in Martil with a “sea view inchallah”, you better play it safe.

Your timeline dictates your emotions. Not Twitter.

3. Diversification: Your Best Cousin

Putting 100% of your money into one stock is like kayaking in Oued Laou in February — risky, freezing, and one small mistake sends you straight to the hospital.

A well-diversified portfolio is your life jacket:

Akdital drops today? Maybe Marsa Maroc and Attijari make up for it.

CFG is flat? LabelVie holds the line.

The real wealth is not losing everything when one corner of the market catches fire.

Last but not least, beside Iran and Israel playing Call of Duty, the market has received the news of the IPO of Vicenne which is set to raise approximately 500 million dirhams through its IPO on the Casablanca Stock Exchange, marking the first major public offering in 2025.

When I look at Vicenne’s IPO prospectus, I see a high-growth healthcare infrastructure company operating in a developing market with significant macro tailwinds. The business sits at the crossroads of Morocco’s national healthcare reform, growing public sector demand, and rising private healthcare expansion. The company enjoys strong positions across equipment, consumables, services, waste management, and early international expansion into West Africa.

The numbers are impressive:

Revenue CAGR of ~12% expected through 2030, following an even stronger 20% growth in 2022–2024.

EBITDA margins rising to >24% by 2030.

Conservative debt profile (net debt dropping to almost zero by 2028).

Disciplined reinvestment and conservative capex.

A stable, deeply anchored shareholder base with strong governance.

Valuation-wise:

At 236 MAD per share, the IPO price implies ~14.6x 2025 earnings and ~8.7x EV/EBITDA — not expensive for a high-quality, niche healthcare platform in an underdeveloped capital market.

The DCF valuation run by the advisors values Vicenne closer to 326 MAD per share — which suggests this IPO is priced with a 27% discount to intrinsic value based on management’s plan.

Their growth assumptions are plausible, but some upside optionality (new partnerships, international scaling) is not fully baked into the forecasts.

But what would make me hesitate?

Government dependency is high — much of Vicenne’s future demand relies on Morocco's GST healthcare reform execution (GST = Groupements Sanitaires Territoriaux= Territorial Healthcare Clusters in English).

Working capital cycle remains long — customer payments drag for several months, which stresses cash flow management.

Liquidity risk in Morocco’s small-cap market should not be underestimated.

The verdict:

"If I can buy a growing, diversified healthcare integrator with expanding margins, clean balance sheet, and national tailwinds — at a 25% discount to its intrinsic value — I’m interested."

In plain words:

✅ This could be a BUY.

But with a key Buffett-style discipline:

I’d buy and plan to hold for years, letting healthcare modernization in Morocco (and beyond) do its compounding.

The views expressed here are solely my personal opinions and do not constitute financial advice, investment recommendation, or a solicitation to buy or sell any securities. Always conduct your own research or consult a licensed financial advisor before making investment decisions

That’s it for the 8h edition of DavLar Weekly Digest. Thanks for reading Davlar Market Digest!

Want more Moroccan market insight with a twist of personality? Subscribe with your email and let’s build a community of smart investors who don’t just follow the market… they understand it.

Here’s your reward for reading to the end

"“Iran and Israel are bombing each other.”

“Quick, sell my Marsa Maroc shares before the port closes haha!”

Until next week — stay wise, stay alert, and stay diversified

Good content. Wish you all the best in next articles.

Is it possible to have an article on investing in OPCVM ?

Thank you for sharing your couscous with us !